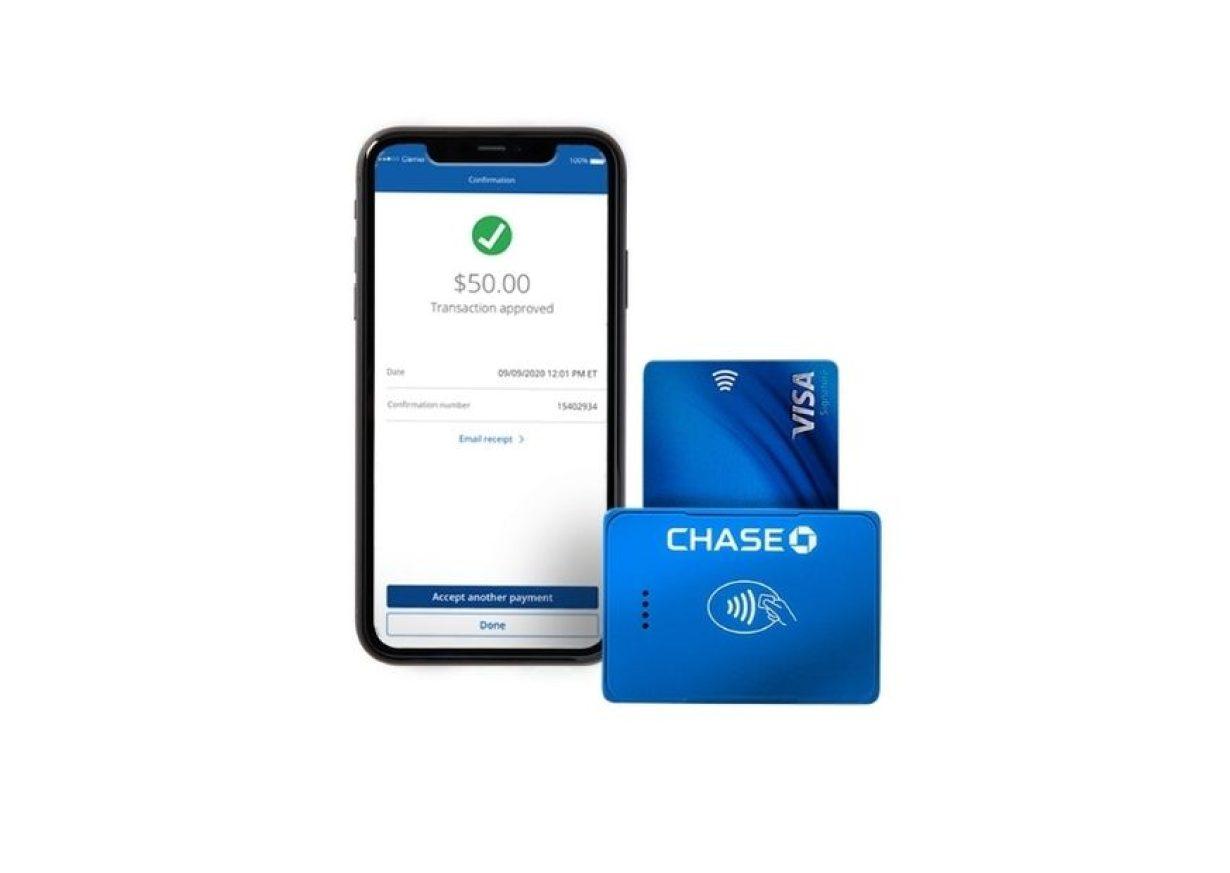

QuickAccept would permit firms to carry out card funds simply and a pay-as-you-go price will solely be paid. QuickAccept has been developed by the WePay crew.

By way of the Chase smartphone app or QuickAccept’s contactless card reader, retailers can assist debit playing cards and bank cards. It’s helpful for each receiving funds in addition to providing digital fee options to retail clients together with the choice of contactless pay, which is sort of common at the moment.

The product can present these with Chase financial institution accounts with same-day transfers with none cost.

The transfer exhibits that JPMorgan, the most important asset financial institution in america, wouldn’t concern itself with permitting new opponents to monopolize the most recent dynamics. Small retailers had been coping with point-of-sale card purchases, however then a number of challenger banks proposed new choices for fee, receiving card funds for a number of currencies. Though standard banks nonetheless cost charges for any transaction, particularly for numerous currencies and abroad, small and medium-sized companies appear to be much more worthwhile with fintech options.

With the Fast Settle for app, truly, such a standard large financial institution like JP Morgan Chase is trying to supply dynamic, low-fee charged, and fast fee and deposit choices. One other level that JP Morgan has given the eye the best way of paying, like QR code and NFC expertise.

What’s aimed with QuickAccept?

- The newest QuickAccept service from JPMorgan permits clients to obtain card purchases inside minutes, both by way of a smartphone app or a contactless card reader, and on the identical day, customers can see transactions attain their Chase accounts.

- Not like rivals like Sq., which often take a day or extra and cost a 1.5 % payment to permit instant transactions, this quick fee technique is delivered freed from cost.

- The financial institution developed its QuickAccept card reader, a {hardware} system that accepts card funds by contact, faucet, or swipe, regionally with assistance from a workforce acquired from its 2017 WePay takeover.

- And on this means, the corporate goals to transform present firm clients to digital fee providers in addition to purchase new ones who appear distant to turning into a JP Morgan buyer because of its trendy and dynamic outlet.

Concluding Ideas: Why conventional banks ought to convert to NFC fee providers?

Simple to make use of.

There’s no coaching to make use of contactless fee! Together with your contactless playing cards, you may pay anytime you see the contactless emblem. Simply carry your card to the POS system close by. Be aware that it’s important to put the contactless card as much as 4 centimeters nearer to the pay go terminal for this buy!

You’ve discretion over your card

You by no means abandon your card whereas making contactless funds, you might be completely in cost! This fashion, on the checkout counter, you can not lose your card and you’ll by no means danger lacking it. With out exchanging your card with others, you’ll really feel the distinction of paying this fashion.

Ought to we have to say it’s hygienic?

Everyone knows how soiled the money is, particularly after Covid-19. There is no such thing as a danger of contamination with contactless fee. Your card doesn’t contact something moreover your hand and your pocket, because of the contactless performance. It’s a clear type of fee with out contact!

A safe and distinctive expertise

Whoever pays with out contact, at all times pays with out contact when you see the worth and ease! Research reveal that customers who make contactless purchases favor all methods of card fee types.

NFC Card NXP NTAG®210μ

NXP NTAG®424 DNA NFC Kind 4 Card | ISO14443-A CR80

NFC Card NXP NTAG®216 NFC Kind 2

RFID Antenna UHF

15-Meter Cable for UHF RFID Fixed Reader

UHF Tag

4″x2″ 860-960MHz UHF RFID Label RFID M4D

UHF Tag

4″x4″UHF RFID Label Alien H3 | ISO18000-6C

RFID Antenna UHF

5-Meter Cable for UHF RFID Fixed Reader

HF Card

ABS RFID KEY-FOB Tag RFID Classic 1K

HF Card

ABS RFID KEY-FOB Tag RFID Classic 4K

HF Card

ABS RFID KEY-FOB Tag RFID Ultralight C

HF Tag

ABS RFID KEY-FOB Tag RFID Ultralight EV1

LF Card

ABS RFID KEY-FOB Tag ATA5577

LF Card

ABS RFID KEY-FOB Tag EM4200

HF Card

ABS RFID KEY-FOB Tag EM4305

HF Card

ABS RFID KEY-FOB Tag RFID TAG 213