In latest a long time, RFID expertise has considerably reshaped quite a few industries, with one of the notable impacts occurring in fee programs. Because the world leans extra towards digital options, the demand for sooner, safer, and extra handy transaction strategies has spurred the widespread use of RFID-enabled fee playing cards. These playing cards not solely improve the consumer expertise but in addition set up new benchmarks for each the safety and pace of fee processing.

On this complete information, we are going to delve into how RFID playing cards are reworking fee programs, their benefits, the expertise behind their operation, and what the long run holds for them within the shortly evolving monetary panorama.

1. What’s an RFID Card?

An RFID (Radio Frequency Identification) card is a card that makes use of radio waves to trade knowledge. These playing cards can talk with a card reader through wi-fi alerts, enabling quick, contactless funds and identification. In contrast to conventional magnetic stripe or chip playing cards, RFID playing cards don’t require insertion or swiping; transactions will be accomplished by merely bringing the cardboard near the reader.

Understanding the expertise behind RFID playing cards is essential for greedy their performance. If you happen to’re new to RFID expertise, you may discover it useful to learn “What’s RFID Know-how: A Complete Information for Newbies“ for an in-depth overview.

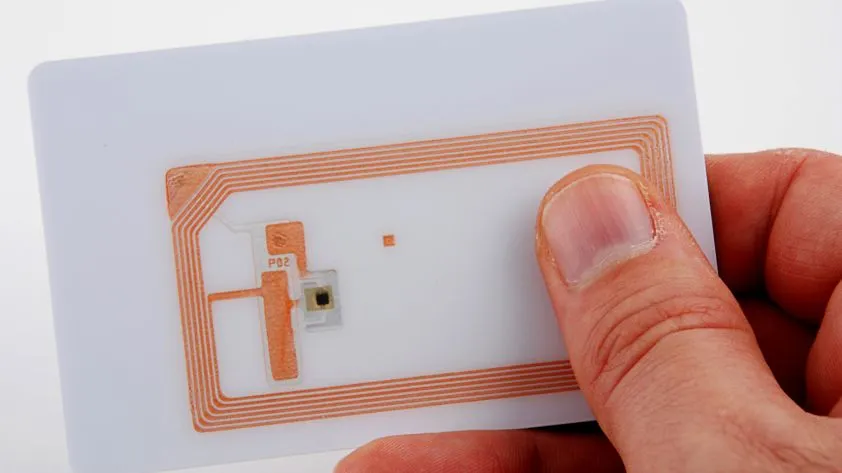

Core Parts of RFID Playing cards

RFID playing cards primarily encompass a chip and an antenna. The chip shops fee info, whereas the antenna is liable for receiving and transmitting wi-fi alerts. Due to their contactless nature, RFID playing cards have gotten more and more well-liked in fee programs, particularly in industries like retail and public transportation.

Principal Sorts of RFID Playing cards

Within the realm of funds, passive RFID playing cards are essentially the most prevalent. They don’t require batteries and function by exchanging power via the radio waves emitted by the reader. These passive RFID playing cards are broadly adopted in fee programs resulting from their affordability and lengthy lifespan.

2. How RFID Playing cards Work in Cost Techniques

In recent times, the “faucet and go” characteristic of RFID playing cards has been embraced by customers who respect quick and seamless transactions. Let’s take a better have a look at the fee course of concerned with RFID playing cards:

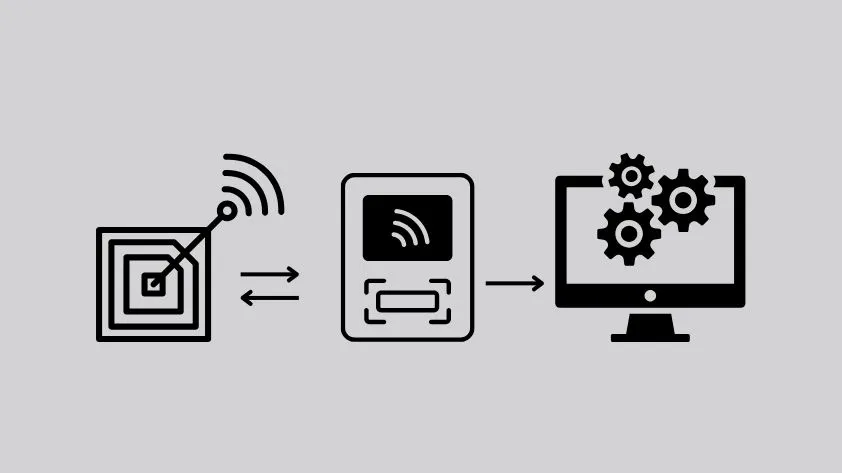

Overview of the Cost Course of

Person Operation: The consumer brings the RFID card or a wise system (like a smartphone) near the fee terminal.

Information Transmission: The chip embedded within the RFID card exchanges knowledge with the reader through wi-fi alerts. This knowledge contains the consumer’s account info and the fee quantity, amongst different particulars.

Verification and Authorization: The fee terminal verifies the cardboard info and establishes a connection to the financial institution or fee system via the community to authorize the fee.

Cost Completion: As soon as the fee is allowed, the transaction is recorded and finalized. Your complete course of sometimes takes lower than a second, making it a lot faster than conventional strategies that require swiping or inserting the cardboard.

The Relationship Between RFID Cost and NFC Cost

Many RFID playing cards are additionally geared up with NFC (close to discipline communication) capabilities, enabling interplay with smartphones and different NFC-enabled units. Which means RFID playing cards can be utilized not just for bodily funds but in addition for digital transactions via sensible units, increasing the vary of fee situations. For example, customers can add their RFID fee card particulars to their cellphones and make the most of the telephone’s NFC operate to make funds, additional enhancing comfort.

3. Cost Benefits of RFID Playing cards

Having gained perception into how RFID playing cards function inside fee programs, let’s now discover the benefits they provide, notably in enhancing fee pace, safety, consumer expertise, and extra.

Velocity and Comfort

One of many biggest benefits of RFID fee playing cards is their pace. With conventional chip playing cards, clients should insert the cardboard into the terminal and await processing. Nevertheless, RFID playing cards allow immediate funds just by tapping the cardboard in opposition to the reader.

Improved Safety

RFID playing cards include enhanced safety features in comparison with conventional magnetic stripe playing cards. These playing cards make the most of encrypted communication between the cardboard and the reader, considerably decreasing the chance of fraud. Moreover, most RFID playing cards are geared up with EMV (Europay, MasterCard, and Visa) chips that generate distinctive transaction codes for every buy, offering an additional layer of safety.

Person Expertise

RFID playing cards streamline fee transactions and supply customers an intuitive, contactless expertise. Clients merely must faucet the cardboard, which reduces friction within the fee course of and enhances general satisfaction.

Hygiene and Contactless Cost

The contactless nature of RFID funds successfully minimizes bodily interplay with the fee terminal, thereby reducing the chance of spreading micro organism and viruses. That is particularly useful in environments similar to shops, eating places, and public transportation, making RFID funds a perfect selection for sustaining hygiene.

Diminished Threat of Put on and Tear

Conventional magnetic stripe playing cards are sometimes topic to put on and injury over time resulting from frequent swiping. In distinction, RFID-enabled playing cards don’t require direct contact with the cardboard reader, which lessens the chance of damage and extends the cardboard’s lifespan.

Time Financial savings and Improved Effectivity

Time effectivity is important throughout many sectors, notably in retail and transportation. RFID funds can considerably cut back transaction occasions and improve the operational effectivity for each retailers and customers.

4. How RFID Playing cards Improve Cost System Safety

As fee strategies turn into more and more handy, the significance of securing fee programs intensifies. Shoppers are extra vigilant about how their monetary knowledge is managed and whether or not their fee strategies are vulnerable to fraud. RFID fee playing cards deal with many of those issues by implementing a number of layers of safety measures, together with:

Encryption Know-how

RFID playing cards are geared up with encryption protocols that guarantee knowledge is transmitted securely between the cardboard and the fee terminal. This makes it considerably more difficult for hackers to intercept or manipulate fee info.

Tokenization

Many fee processors make the most of tokenization as an added safety measure. Tokenization replaces delicate fee info with a novel, randomly generated code or tag. Which means even when fraudsters handle to intercept the communication, they received’t have the ability to entry the precise fee particulars.

Two-Issue Authentication

Some RFID fee playing cards additionally make use of two-factor authentication (2FA) strategies, similar to fingerprint scanning or PIN codes, to confirm the id of the cardholder earlier than processing transactions.

EMV Chip Know-how

EMV chips supply dynamic authentication for every transaction, making it significantly tougher for fraudsters to duplicate or clone playing cards. This characteristic considerably bolsters the general safety of RFID fee programs.

5. Sensible Purposes of RFID Playing cards in Cost Techniques

After recognizing the fee benefits of RFID playing cards, let’s delve into the sensible functions of RFID expertise throughout varied industries, illustrating the way it revolutionizes fee and administration strategies in retail, transportation, lodges, and past.

Retail and E-commerce

The implementation of RFID fee playing cards within the retail sector has turn into more and more mainstream, notably in self-checkout programs and cashless fee choices. Increasingly shops are using RFID expertise to facilitate a sooner checkout expertise. Shoppers can merely swipe and pay, considerably slicing down wait occasions. For example, a number of massive supermarkets and buying malls have begun utilizing RFID fee programs, enhancing the buying expertise by making it smoother and extra environment friendly. Moreover, with the continued development of e-commerce, RFID playing cards are additionally being built-in into on-line fee and membership administration programs, offering customers with a extra seamless buying expertise.

Public Transportation

The usage of RFID fee playing cards in public transportation programs is especially impactful. Many city public transportation networks have began adopting RFID expertise to switch conventional paper ticketing programs. For instance, London’s Oyster Card and New York’s MetroCard are outstanding examples of RFID transportation playing cards. These playing cards allow riders to shortly cross via gates with a easy swipe, eliminating the trouble of queuing for tickets, whereas minimizing handbook operations and enhancing site visitors effectivity. RFID expertise not solely will increase comfort but in addition provides real-time knowledge, permitting site visitors administration businesses to research passenger move and optimize scheduling extra successfully.

Motels and Lodging

RFID playing cards are more and more prevalent within the resort business, particularly with the rise of sensible lodges and contactless providers. RFID key playing cards are ceaselessly used as room entry playing cards, permitting friends to enter their rooms by merely swiping the cardboard—eliminating the chance of dropping conventional keys. Moreover, RFID expertise will be built-in with fee programs to supply a complete contactless fee expertise. For instance, friends can conveniently pay for meals, lodging, and different providers utilizing RFID playing cards, streamlining the checkout course of and enhancing the general buyer expertise.

Merchandising Machines and Good Gadgets

With developments in RFID expertise, many merchandising machines and sensible units have began incorporating RFID fee programs. Shoppers can buy gadgets utilizing RFID playing cards with out the necessity for money or card readers. This strategy not solely enhances transaction effectivity but in addition reduces handbook intervention, elevating the automation degree of those machines. Furthermore, RFID playing cards are additionally being utilized in sensible parking programs, shared bicycles, and rental providers, providing extra handy and clever fee options.

6. RFID Playing cards and Their Position in Future Funds

As we progress towards a cashless society, RFID fee playing cards are poised to play a pivotal function in the way forward for funds. Listed here are some potential traits and developments we will anticipate within the coming years:

Integration with Cell Wallets

With the surge in recognition of cellular fee options like Apple Pay, Google Pay, and Samsung Pay, RFID fee playing cards will seemingly see extra seamless integration into cellular wallets. This improvement will allow customers to faucet their smartphones on fee terminals, offering the identical comfort as utilizing bodily RFID playing cards.

Biometric Authentication

Sooner or later, RFID fee playing cards could also be paired with biometric authentication applied sciences, similar to facial recognition or iris scanning, so as to add an additional layer of safety throughout transactions. This development will make it more and more troublesome for fraudsters to achieve unauthorized entry to customers’ fee info.

Integration with IoT Gadgets

The Web of Issues (IoT) is anticipated to affect the evolution of RFID fee programs considerably. Sooner or later, because of the seamless integration of RFID expertise, customers could possibly make funds instantly via related units, together with smartwatches, wearable health trackers, and even sensible dwelling home equipment.

Enlargement of Contactless Funds

RFID-enabled playing cards are set to turn into the usual for in-store funds as extra companies undertake contactless fee options. RFID playing cards are already utilized throughout varied sectors similar to transportation, retail, hospitality, and leisure, and RFID playing cards will see elevated utilization as infrastructure improves, resulting in widespread acceptance.

7. Challenges and Options of RFID Card Cost

Whereas RFID fee expertise has demonstrated vital potential to reinforce fee experiences, comfort, and safety, it nonetheless faces a number of challenges and concerns because it seeks to attain widespread adoption. On this part, we’ll discover the privateness, system compatibility, and client notion points related to RFID card fee expertise, in addition to talk about potential options for wider implementation.

Privateness Points

As RFID fee expertise turns into extra prevalent, privateness and knowledge safety issues have emerged as crucial points. RFID playing cards talk with fee terminals through wi-fi alerts, posing a danger that criminals may intercept customers’ fee info, particularly within the absence of encryption measures.

Though most RFID fee playing cards make the most of encryption expertise and dynamic tokenization to forestall knowledge breaches, customers should still harbor issues in regards to the security of their private fee knowledge. To deal with these privateness points, fee service suppliers and expertise builders should prioritize the implementation of superior safety measures, similar to encrypted communication, digital authentication, and biometric expertise functions.

Furthermore, some customers may fear about unauthorized third events scanning or studying their RFID card info. To mitigate this danger, RFID card producers are growing “anti-eavesdropping” applied sciences, together with “anti-scanning” card sleeves and shielding mechanisms designed to successfully forestall unauthorized scanning, thereby enhancing client confidence in RFID funds.

System Compatibility

Regardless of the widespread adoption of RFID fee playing cards in lots of areas, compatibility with current fee programs poses a big problem. Quite a few retailers and retailers nonetheless depend on conventional magnetic stripe or chip card programs, making it important for retailers and fee service suppliers to improve their programs and rework their infrastructure to facilitate RFID fee functions.

For example, present point-of-sale (POS) terminals want {hardware} able to supporting RFID fee capabilities to work together with RFID playing cards successfully. Plus, retailers should make sure that their RFID fee programs stay appropriate with different fee strategies (like cellular funds, bank cards, and debit playing cards) to keep away from technical points throughout transactions. Due to this fact, the fee business should put money into innovation and standardization in infrastructure and expertise.

Shopper Consciousness and Schooling

Whilst the recognition of RFID fee expertise will increase, some customers nonetheless lack a stable understanding of the expertise and should maintain reservations about its safety and privateness implications. To reinforce client understanding of the benefits and capabilities of RFID funds, retailers, fee platforms, and card issuers must ramp up academic efforts.

By providing clear info and easy-to-follow tutorials, customers shall be higher geared up to know how RFID fee playing cards function and the best way to safeguard their private fee info. Moreover, retailers ought to present easy utilization guides to ease customers into adopting contactless fee strategies. For instance, many retailers can show indicators or QR codes in-store that information clients via the fundamentals of RFID fee.

Moreover, governments and regulators may play a job by establishing requirements and specs that assist the wholesome improvement of RFID fee expertise throughout the fee ecosystem. This not solely builds client belief but in addition encourages the general development of the fee business.

Know-how Improve and Standardization

To make sure the environment friendly operation of RFID fee programs, ongoing upgrades and standardization of fee expertise are important. Whereas RFID expertise has superior considerably, there stay disparities in requirements and protocols in several nations and areas. For example, variations in RFID frequency bands or encryption strategies may trigger compatibility points for cross-border funds or worldwide transactions.

To create a seamless fee expertise globally, the fee business should set up unified technical requirements that assure compatibility between RFID playing cards and fee units throughout varied nations, areas, and fee networks. This is able to not solely simplify the fee course of but in addition promote the worldwide adoption of RFID funds.

8. How Companies Can Profit from RFID Cost Techniques

RFID fee programs not solely improve fee effectivity but in addition present substantial operational benefits for companies. Because the expertise continues to evolve, enterprises can take pleasure in extra environment friendly transaction processes, decreased operational prices, and improved buyer experiences when incorporating RFID fee options. Right here’s a better have a look at how RFID fee programs may help companies meet these targets:

Enhance Transaction Velocity and Effectivity

One of the vital vital advantages of RFID fee programs is their capability to dramatically enhance fee pace. In contrast to conventional fee strategies (like card insertion and swiping), RFID funds can full transactions virtually instantaneously, permitting clients to finalize their purchases with only a faucet. Throughout peak hours, this quick checkout functionality not solely boosts buyer satisfaction but in addition helps retailers lower buyer wait occasions, in the end growing transaction quantity.

For retailers, sooner fee speeds have a direct influence on gross sales development. Clients can full extra transactions in much less time, optimizing retailer operational effectivity and driving increased charges of buyer return.

Diminished Working and Upkeep Prices

Conventional fee strategies typically necessitate expensive {hardware} that requires ongoing upkeep and updates, whereas the technical prices related to RFID fee programs are usually decrease. Retailers profit from eliminating the necessity for paper receipts for each transaction, as all fee information will be generated electronically in actual time, which reduces each printing and storage bills.

Moreover, RFID fee programs sometimes characteristic a protracted lifespan, minimizing the necessity for frequent repairs or replacements resulting from tools put on and tear. Moreover, retailers can decrease extra working prices tied to money administration—similar to deposits, withdrawals, counting, and general money logistics.

Optimize Buyer Expertise

RFID fee programs considerably improve the fee expertise for patrons by streamlining the method. Clients now not have to attend for playing cards to be swiped or passwords to be entered—they’ll full funds just by bringing their card or system near the reader. This contactless fee strategy creates a smoother buying expertise, reduces wait occasions, and enhances general buyer satisfaction.

This profit is particularly pronounced in environments that demand fast fee options, similar to eating places, quick meals shops, and retail shops. Clients not solely obtain sooner service but in addition understand a extra fashionable and technologically refined model picture.

Improve Model Competitiveness

As client preferences more and more shift towards contactless funds, firms that undertake RFID fee programs can showcase their technological innovation, distinguishing themselves in a aggressive market. That is notably related amongst youthful customers, who worth handy and superior fee strategies—these programs contribute to enhanced model attraction and elevated buyer loyalty.

By implementing RFID fee programs, companies can constantly elevate their model picture and keep present with client expectations, guaranteeing they meet the excessive demand for comfort and safety in at this time’s fee panorama.

Conclusion

With the continued development of expertise, RFID playing cards are essentially reworking the fee system with their pace, safety, and comfort. From retail to public transportation to sensible units, RFID fee options have delivered a extra environment friendly fee expertise for customers throughout the globe. They not solely improve transaction pace and bolster fee safety but in addition afford retailers a cheaper and environment friendly operational mannequin. As client demand for contactless fee choices continues to rise, the way forward for RFID expertise is brimming with potential.

For companies, adopting RFID fee options is an important technique for elevating buyer expertise, reducing working prices, and bettering model competitiveness. For customers, RFID fee signifies a transition to a extra handy, safe, and fashionable fee panorama.

If your organization is searching for RFID fee options, don’t hesitate to succeed in out to us. Our skilled group is able to offer you a personalized RFID fee system designed to reinforce buyer expertise and assist develop your enterprise.

FAQs

1. Is RFID safe?

Sure, RFID expertise is safe. It employs encryption and tokenization to safeguard transaction knowledge. Most RFID playing cards are additionally geared up with EMV chips that generate a novel code for every transaction, including an additional layer of safety in opposition to fraud. Nevertheless, to make sure most safety, it’s essential to make use of RFID playing cards inside safe networks and implement sturdy authentication protocols.

2. Can I exploit my RFID fee card internationally?

Sure, many RFID fee playing cards are accepted globally, notably those who belong to main fee networks similar to Visa, MasterCard, or American Specific. These playing cards are designed for worldwide use, enabling customers to make seamless funds in varied nations.

3. How do RFID playing cards evaluate to NFC funds?

RFID and NFC (Close to Area Communication) are each contactless applied sciences; nonetheless, NFC is a subset of RFID. RFID is usually utilized in entry management, stock administration, and fee programs, whereas NFC is mostly employed for cellular funds and knowledge trade between units (like smartphones and smartwatches). NFC funds are ceaselessly built-in into cellular wallets (similar to Apple Pay or Google Pay), whereas RFID playing cards are primarily used as bodily playing cards for transactions.

4. Will RFID funds change bank cards sooner or later?

RFID funds have the potential to supplant conventional bank cards, however it’s extra seemingly they may coexist with current fee strategies within the close to time period. As extra customers and companies embrace RFID and contactless applied sciences, it’s potential that RFID playing cards may turn into the popular selection for small, on a regular basis transactions. Nevertheless, bank cards and different fee varieties will seemingly stay in use for extra advanced or high-value transactions for the foreseeable future.

Advisable Product

RFID Antenna UHF

15-Meter Cable for UHF RFID Fixed Reader

UHF Tag

4″x2″ 860-960MHz UHF RFID Label RFID M4D

UHF Tag

4″x4″UHF RFID Label Alien H3 | ISO18000-6C

RFID Antenna UHF

5-Meter Cable for UHF RFID Fixed Reader

HF Card

ABS RFID KEY-FOB Tag RFID Classic 1K

HF Card

ABS RFID KEY-FOB Tag RFID Classic 4K

HF Card

ABS RFID KEY-FOB Tag RFID Ultralight C

HF Tag

ABS RFID KEY-FOB Tag RFID Ultralight EV1

LF Card

ABS RFID KEY-FOB Tag ATA5577

LF Card

ABS RFID KEY-FOB Tag EM4200

HF Card

ABS RFID KEY-FOB Tag EM4305

HF Card

ABS RFID KEY-FOB Tag RFID TAG 213